partners for life

Should You Pay Down Debt or Increase Your Super Balance?

For Australians with a home loan, or other significant debt, to pay it down and watch your loan balance gradually reduce is a well-trodden path. So, too, is seeing your superannuation balance gradually increase as your employer makes contributions. But where does that leave us in 10, 20, 30+ years from now? Those with cash to invest can choose to accelerate their home loan repayments and pay off their mortgage sooner; or make additional super contributions to increase their income in retirement. Which route is best depends on a few factors, so let’s run the numbers.

Pay Down Your Loans

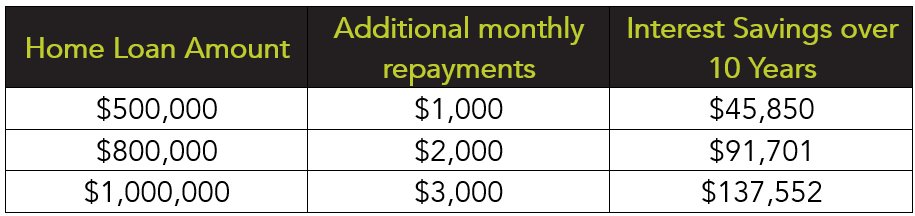

Given the average home loan has a 30-year term, getting out from under that debt early certainly sounds appealing. Once that loan is paid off, the home is yours to do with as you please – including the option to rent it out or sell it and enjoy all the proceeds, without having to hand any back over to a lender! What’s more, you’ll have paid less interest than if you had seen out the full term. To see if it stacks up, here are a few examples of the interest savings possible over time, when additional monthly repayments are made.

Note: these figures assume interest rates remain at 6.22%.

Increase Your Super Balance

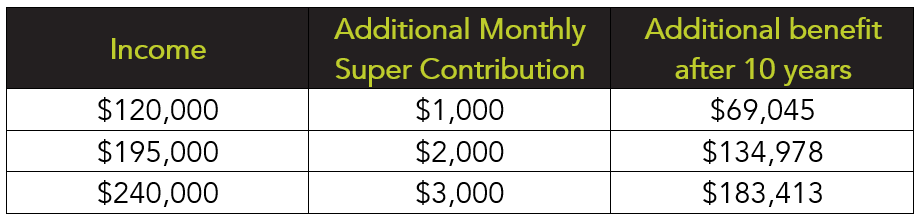

Looking longer-term, those with additional cash could look to increase their superannuation balance through concessional and non-concessional contributions. Investing in your retirement nest egg has obvious benefits, including the fact a higher super balance can increase further in value through strong investment returns, and enjoy the rewards of compound interest. To illustrate this, the following table outlines the potential benefits over 10 years of making additional contributions to super, based on an individual’s income, estimated tax savings of those contributions, and estimated investment earnings.

Note: these figures assume the current seven-year average super return of 7.6% remains, and that the current additional contribution cap remains at $30,000. For more on contribution caps, see our article here.

Pay Down Loans vs Top Up Super – Pros and Cons

If you look at the figures alone, additional superannuation contributions appear to stack up better financially. However, a key factor that holds many people back from making additional superannuation contributions is the fact that they cannot access their funds until retirement (at least age 60 for those born after 1 July 1964). Additional home loan repayments, on the other hand, could be accessed via a redraw facility on your home loan – meaning you can take that money back out again should you need it. Another consideration is the tax and investment diversification upsides of super contributions. Retiring with several years of additional contributions, as well as the tax and investment returns, could significantly increase your retirement income, opening up opportunities to enjoy your retirement in ways you couldn’t if you were retiring with less. This could be overseas holidays, more money to leave for your family when you pass away, a new 4WD and caravan to go travelling – whatever you like! Fundamentally, everyone’s circumstances and goals are unique, and choosing to pay down debt, contribute to super, or otherwise, should be under the guidance of a financial adviser.

Making the Most of Your Money with MP+

The Wealth team at McKinley Plowman advises clients on how to maximise their wealth, for now and into the future. Many clients engage us to help set themselves up for retirement years before they plan to leave the workforce. The longer the timeframe available to invest, save, pay down debt, and increase superannuation, the better the outcome tends to be. If you’re ready to start your retirement planning journey with McKinley Plowman, reach out to our team on 08 9325 2411 (Perth), 08 9301 2200 (Joondalup), or via our website.

Please note the information provided within this article is general of nature and is not a personal advice recommendation. Prior to considering strategies discussed in this article we recommend you seek personal financial advice. Please be aware that, without the benefit of financial advice, you may be committing yourself to financial strategies or products that are not appropriate for your overall personal situation, needs and objectives.

Modelling from Canstar.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today