partners for life

Market Volatility Update – April 2025

As you may have observed recently, investment market volatility and global uncertainty have again come to the forefront, putting many investors on edge. We want to take this opportunity to provide you with important context, highlight recent global developments, and reinforce the importance of focusing on long-term investment fundamentals during periods like this.

What’s Driving Market Volatility Right Now?

Global Markets – Heightened Uncertainty and Tariff Tensions

March and April have been dominated by a “risk-off” sentiment across global markets. Investor concerns were reignited by the announcement of new US tariffs in early April, which follow the ongoing and evolving tariff disputes under President Trump’s administration. Although a 90-day pause was initially announced, China remains a key target, and reciprocal tariffs continue to undermine global business confidence.

These trade tensions, coupled with an already uncertain economic backdrop, led investors to reassess future risks and the valuation of equity markets. Although the US economy still shows strength on paper—low unemployment and solid job growth—the risk of higher inflation and slower growth is becoming more pronounced. Estimates suggest that tariffs could push US inflation up by 2% and cut growth by 1%.

Market Volatility: Closer to Home

For Australian investors, recent market activity has presented somewhat of a mixed bag. Aussie fixed-rate bonds appear strong, thanks in no small part to falling inflation expectations. However, equity markets have been negatively impacted, particularly in sectors that are linked to the global supply chain. China’s ongoing tariff war with the US, and their subsequent stimulus package (likely to come shortly), should continue to support demand for Australia’s resources. This is positive in the short term, however the uncertainty around the situation will continues to play on investors’ minds as time goes on.

Maintaining a Long-Term Perspective

“Time is your friend, impulse is your enemy” – John Bogle

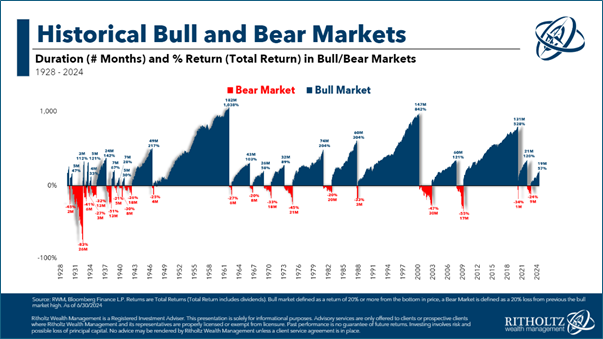

During volatile times like this, where uncertainty is rife and everyone has an opinion, it is critical to remain rational and maintain a longer-term perspective. The vast majority of investors are invested for long periods of time and it is normal for markets to move in cycles and experience short-term volatility, particularly in growth assets. Staying invested and riding the bumpy roads when they come along is part of the investment journey. Historically speaking, ‘bear markets’ (falls of more than 20%) last significantly less time than subsequent rising ‘bull markets’. See the graph below for more information.

Bear and Bull Market Periods to 2024 – Source: Ritholtz WM

Having the experience of a dedicated Wealth professional on your side, like the team at McKinley Plowman, means that you can be confident in your investment strategy. Every day, our team places investment trades, rebalances portfolios and processes withdrawals for our clients, using our skills and experience to act in their best interests. This often includes averaging tactics and specific drawdown strategies to mitigate risk. These strategies are managed in conjunction with our dedicated third-party researcher houses and institutional investment managers.

Understanding Short-Term Reactions to Market Volatility

It is completely understandable that in times like this the natural reflex for an investor may be to cash out when the news is bad. Unfortunately, many people who do this incur transaction costs, potential tax and only buy back in when the economic sunshine has returned, potentially missing out on most of the recovering upswing in markets.

It’s generally misunderstood but important to recognise that markets are often forward looking and when there is fear over the future health of the economy, substantially higher interest rates or even a global recession, this has often already been priced into the market. Further, a recent survey of professional investors indicate high levels of pessimism in markets. Similarly pessimistic readings in 2015, 2016, 2018, 2020 and 2022 occurred near market bottoms and therefore it is more important than ever to remain rational and not lose focus on your longer-term objectives.

Overall, during uncertain periods, it’s essential to:

- Stick to your long-term investment strategy

- Avoid reacting impulsively to headlines

- Speak with us before making changes

- Understand that markets often price in pessimism before a downturn actually occurs

We’re Here if You Need Us

An important part of our ongoing advice relationship is our formal annual advice meeting. We also need to check in with each other when circumstances, legislation or economic conditions change. When times are uncertain, good communication is the key – so if you are concerned about the current market volatility and how it impacts your portfolio, please reach out to us via our website or call us on 08 9301 2200, and we will be happy to talk or meet with you to discuss.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today