partners for life

Property

New Withholding Rules for Property Sales

June 21st, 2016Please note we have released an update on this in 2025 - read that here. New rules apply from 1 July 2016 to prevent foreign residents avoiding tax when they sell Australian property. However, the new rules will affect everyone (both residents and non-residents) buying or selling property with a market value of $2read more

Rental Property Owners Encouraged to Understand Obligations

June 17th, 2016With just days away from Tax Time, the Australian Taxation Office (ATO) is encouraging owners of rental properties to learn more about their tax obligations to be able to lodge and claim their deductions correctly. Assistant Commissioner Gramham acknowledges that lodging taxes can be "tricky" for rental property owners. That's why it is important forread more

Tax Deductions: Repairs vs. Improvements on Rental Properties

June 1st, 2016The Australian Taxation Office (ATO) is focusing on the claims of property investment owners with regards to the “improvements” of their rental residences. Oftentimes, investors will have some work done on their newly purchased properties and would claim these as “initial repair” when discussing the tax implications of these property works. However, the Tax Officeread more

Is it time to jump out the Investment Property window?

May 10th, 2016The window of opportunity for Investment Property in Perth and for that matter in Australia has potentially never been greater. Just about every property market in Australia may be around rock bottom. Unemployment is at a high. Interest rates are at record lows. Days on market for property sales are coming off high numbers. It’s aread more

Foreign Resident Capital Gains Tax Withholding

April 21st, 2016The new withholding system that will apply when non-residents dispose of certain taxable Australian property starts from 1 July 2016. In very broad terms, when a non-resident disposes of certain taxable Australian property (e.g., land and building in Australia) the purchaser will generally be required to withhold 10% of the purchase price and pay thisread more

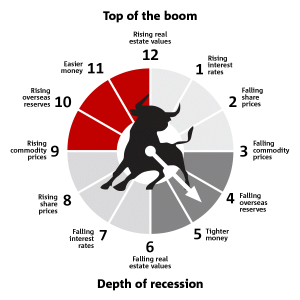

Most Property Investors are Gamblers

April 19th, 2016Most property investors are gamblers. Speculating that the value of a property will rise is like hoping your numbers in the lotto will come. Every week we fork out money for the lotto numbers dreaming that we will become millionaires one day hopefully. For some investors who have a negative cashflow they fork out moneyread more

Positive Cashflow Properties

March 31st, 2016If you have a mortgage on your home, did you know that with certain investment property strategies, you can “Borrow yourself out of debt”? It’s true. We hear so much about Negative Gearing and Positive Gearing. Negative Gearing strategies come with negative cashflows and tax deductions on these losses. Building a property portfolio using negativeread more

Do I develop or sell?

March 14th, 2016If you own property in an area that is undergoing a change in its housing density it is a tremendous opportunity to create real wealth for yourself. You have so many choices to consider. Do I sell and realise some of the increase in value of my land? Do I hang on to the propertyread more

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today