partners for life

Taxation

McKinley Plowman Federal Budget Update 2020/21

October 7th, 2020Welcome to the 2020/21 McKinley Plowman Federal Budget Update! In a year filled with uncertainty, turmoil, crisis, and economic downturn, the Morrison Government’s Budget was always poised to be one filled with recovery measures to get the Australian economy back on track – looking at both the short- and long-term. While the majority of theread more

COVID-19 Compliance at Tax Time

August 19th, 2020Have you applied for COVID-19 stimulus payments for your business? Have you received the JobKeeper payment as an employee? Taken advantage of the Early Release of Super scheme? There are plenty of compliance-related considerations this tax season! After an unusual and challenging second half of the 2019/20 financial year, we’re certainly not out of theread more

JobKeeper 2.0 – The Next Chapter

July 23rd, 2020**Updated following announcement on 6 August 2020** The original JobKeeper payment was announced by the Federal Government in late March 2020 in response to COVID-19 and comprised a $1500 per fortnight wage subsidy for businesses so they could continue to pay eligible workers. For the most part, this payment helped keep people employed and theirread more

Working from Home Deductions: The COVID-19 Shortcut Method

July 10th, 2020Not only has COVID-19 changed the way we socialise and live life day-to-day, the working from home landscape has shifted significantly. What used to be a flexible working arrangement predominantly offered by employers to allow staff to do things like look after children, reduce travel or improve work-life balance, has now evolved into something thatread more

JobKeeper Package – What You Need to Know

April 1st, 2020The Australian Government has announced a third stimulus package, which is welcome relief for businesses and employees alike. The ‘Job Keeper’ Package will subsidise wages of $1,500 for each eligible employee (per fortnight) for a period of up to six months for all eligible businesses. In case you’ve missed out previous updates on the stimulus packages, feelread more

The Return of the Superannuation Guarantee (SG) Amnesty

March 26th, 2020As we’ve outlined in a previous article, the government’s Superannuation Guarantee (SG) Amnesty was initially introduced in 2018. The SG amnesty has now been resurrected, and employers are once again being afforded the opportunity to rectify SG issues. So - what should you do if you think you have outstanding contributions owing? The SG Amnestyread more

Main Residence CGT Reforms for Expatriates

January 31st, 2020In the constantly shifting landscape of Australian legislation and tax reforms, it can be tricky to keep up – even if you’re living here. But what if you move overseas? Aussie expats who sell their former family home are generally entitled to some or all of the Main Residence Capital Gains Tax (CGT) exemptions onread more

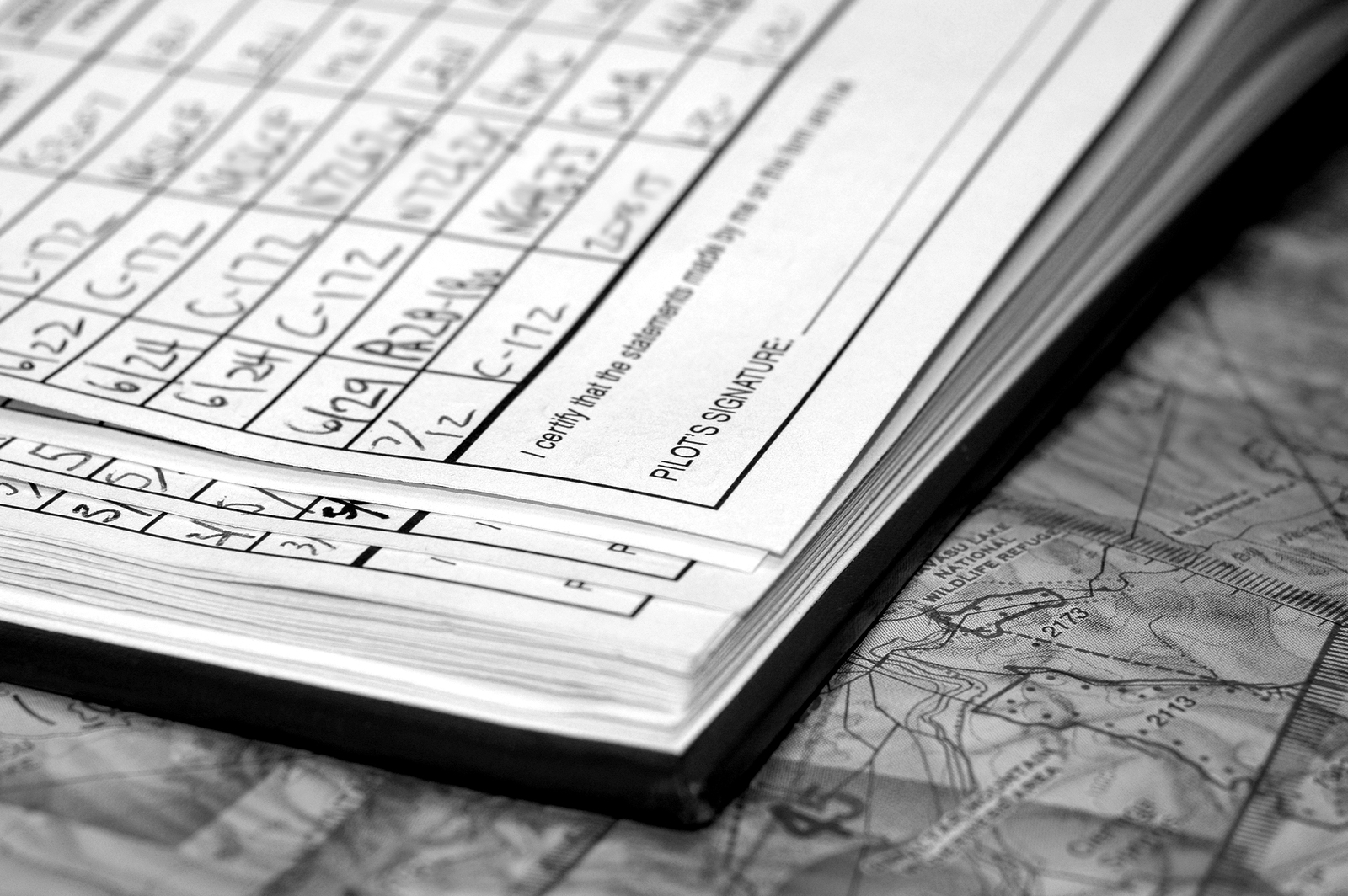

Logbooks – Tax Savings vs. Tax Headaches

November 25th, 2019Travelling for work often means tax deductions – great news at tax time, especially if you aren’t keen to line the tax man’s pockets with any more money than absolutely necessary. But what happens when you get it wrong? Intentionally or otherwise, the Australian Taxation Office (ATO) is becoming increasingly vigilant when it comes toread more

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today