Partners for life

Home » our services

our services

how we work with you

People come to McKinley Plowman at many different stages of their personal or professional lives. Our team has developed a varied range of services and work systems that allow us to offer guidance and great advice for every conceivable situation. We establish where you are now and ascertain where you, your business and your family wish to be in the future. The common aim here is generally the desire to achieve a future that is financially secure and free of debt.

We begin our process with a financial gap review which discovers the ‘here and now’, before moving on to the development of a Life Plan. McKinley’s unique integration between teams and skill sets means that, with regular reviews, we can adjust your approach as conditions change and still achieve all of your personal and professional goals.

So whether you are after just one or a number of our services, including accounting, taxation, business improvement, wealth, finance, pensions, property, cfo2go, brand plus, and self-managed superannuation, McKinley Plowman are equipped to help you as one of the top accounting firms in Perth. What’s more, our team’s dedication to excellent service and delivering great outcomes has been recognised nationally in the 2023 Client Choice Awards.

We also have online financial calculators for your convenience – including an income tax calculator, loan repayment calculator and more.

Get in touch with our team today and begin your journey with McKinley Plowman. Partners for life.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

New Client Options

Book a FREE no obligation consultation

Pick a date and time which suits you for a meeting at our Joondalup or Perth Office via our online booking system. This free consultation is available to new clients.

Get in touch with a MP+ representative

Fill in our online enquiry form and one of our friendly staff members will be in touch.

Contact Us

Contact Us

accounting

- key services

- financial & kpi reporting

- accounting systems and support

- valuations

- due diligence

- financial modelling & projections

Working in the moment and looking to the future. For over 25 years Perth accountants McKinley Plowman have been creating great outcomes and stories of success for individual clients and companies alike, using a combination of peerless skill and hard work.

As a leading accounting firm in Perth, our reputation is shaped by the highest standards of integrity and mutual respect. We deliver complete accounting and taxation solutions for individuals, small businesses, sole traders, trusts, partnerships, companies and corporations.

Experienced and diversified, our practice is devoted to excellence and innovation in developing the most appropriate accounting and tax strategies. Additionally, our broad international tax experience and global affiliations are perfect for clients who do business in other parts of the world.

Continue Reading

Read more advice and tips about accounting and tax strategies on our blog, or check out our online financial calculators, including a compound interest calculator, borrowing power calculator and income tax calculator.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

taxation

- key services

- tax compliance

- tax planning

- audit representation

- structures

- tax consulting and strategy

We find there’s nothing more satisfying in our work than being able to make our clients’ day; sharing in their success because we’ve been able to improve their business or personal finances through tax minimisation. Navigating the muddy waters of tax no longer has to be a burden for business owners – we put in the hard yards to make your life easier.

Our expert team of ‘tax specific’ accountants provide complete solutions for individual, business and corporate tax. Our collective expertise is reflective of a large city practice, yet McKinley Plowman clients enjoy the convenience, competitive fee structure and personal service of a suburban practice.

Our clients include private individuals, businesses, trusts, partnerships, companies and entrepreneurs. Our taxation team’s linkage with financial planning and finance enables McKinley Plowman advisers to take a holistic approach to clients’ tax affairs and develop tax strategies to support their current and long-term goals.

Continue Reading

For your convenience, we have online finance calculators for your tax needs, including an income tax calculator, budget planner, stamp duty calculator, and many more.

When it comes time to lodge your personal, business and rental property tax returns, it’s important that we have all the right information from you to ensure the process runs efficiently, and to make sure lodgement deadlines are reached. The information on this page will guide you through the steps: MP+ Making Your Tax Return Easy!

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

business improvement

- key services

- strategic planning & operating rhythm

- team engagement & advisory boards

- change management & succession

- systems and processes development & review

- management reporting & kpi analysis

- business plans

- structure review

Taking a two-man show and turning it into one of WA’s most successful independent accounting firms means we know a thing or two about business improvement.

We do much more than simply enhance your business growth and profitability. With McKinley Plowman’s strategic business improvement services, we show small business how to think like big business and realise their full potential.

If your business is already big, our suite of services cater to a multitude of improvement and strategic outcomes, as well as pathways to exit.

Offering strategic planning, business planning, team advisory, customer advisory, change management, system and process improvement, marketing and education in business mastery, owners and managers are challenged to embrace perspectives for success.

Continue Reading

If you’re wanting to reach the potential of your business, read more of our business tips on our blog

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

wealth management

- key services

- investments

- personal insurance

- retirement planning

- budgeting and cash flow management

- business succession and keyperson insurance

- estate planning

Achieving financial security means different things for different people. It’s not just financial, it’s also aspirational. With a focus on what is important to you, and a financial road map to guide you, you will get it right and for many of our clients for many years, we have been helping them do just that.

Create wealth, build on it and then protect it, whether it be achieving a unique personal financial goal, retiring early, ensuring a champagne lifestyle in retirement, or setting the foundations for future wealth, McKinley Plowman have the team and the tools to achieve it.

Our extensive range of wealth services are complemented by our self-managed superannuation, insurance and estate planning services to consolidate all of your financial planning needs in one place, and our professional advisors and their close relationship with our accounting and finance broking divisions enable us to provide a holistic financial planning service that is completely tailored to your needs.

Continue Reading

MP Financial Planning Pty Ltd and its advisers are Corporate Authorised Representatives (AR) of Fortnum Private Wealth Ltd ABN 54 139 889 535 | AFSL 357 306

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

View our Financial Services Guide

Read more on wealth creation tips, investments and superannuation on our blog

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

finance

- key services

- loan relationship management

- competitive tendering process

- business loans

- home loans

- investment loans

- equipment and vehicle finance

- invoice/debtor finance

- superannuation loans

- loan health check/rate review

Do you want it for family? Do you need it for business? Would you like it for fun?

McKinley Plowman provides complete financial solutions for homebuyers, investors, business owners and, when you consider our in-house relationship with accounting and financial experts, it ensures clients obtain the best possible solution for their personal or commercial lending needs. We’re accredited members of the Mortgage & Finance Association of Australia (MFAA) and with access to up to 30 blue-chip lenders, our finance services cover a range of personal and business requirements at terms and pricing that suits your individual needs.

We even set up competitive tendering processes for commercial clients to get the banks to bid for their business, delivering finance options with reduced interest rates, lower fees, improved merchant facilities and streamlined banking processes with our brokers acting as your personal relationship manager.

Some of our lenders

*Lending services are authorised by MPM Finance Pty Ltd ABN 29 113 708 937 Australian Credit Licence No. 386354.

Continue Reading

Read about budget updates, financial advice and tips on our blog

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

pension transfer

- key services

- UK pension consulting

- maximising UK state pension benefits

- tax advice

We assist migrants to thrive in their new home and take advantage of the abundant business, employment and lifestyle opportunities offered in WA.

Whether you’re here on a permanent or temporary visa, we’ll guide you through the myriad of financial, commercial, insurance and legal issues that occur when relocating. Whether it be maximising your entitlement to a UK State pension, tax planning, personal investment, buying a business or sourcing finance for commercial, investment or personal needs, we provide tailored solutions to suit your circumstances.

For transferring your UK Pension to Australia, the team at Pension Transfer Specialists are on hand to answer any questions and help you through the process.

We act as a business network for clients, putting them in touch with reliable professionals in the areas of real estate, legal services and insurance. Even if you’re still in the United Kingdom and thinking about your move, McKinley Plowman can demonstrate how your pension assets can be used to build a solid foundation in Australia.

Continue Reading

PTS Financial Planning is the trading name of PT Services (WA) Pty Ltd. PT Services (WA) Pty Ltd and its advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306

Pension Transfer Specialists (PTS) are the providers of the UK State Pension Service.

Visit our blog for more info and the latest updates in UK Pensions.

UK Pensions Enquiry'

property

- key services

- investment property structuring

- investment property strategies

- investment property analysis

- investment property reviews

- property development

Our property people are specially selected professionals, market proven property and development experts. From your perspective, this means you’re in very good hands indeed.

Whether you are a first time investor or a seasoned property developer, collectively we boast a portfolio of national properties and up-to-the minute research intelligence when advising on critical issues such as investment feasibility, asset protection, depreciation and tax minimisation to suit your circumstances. In advising clients, we help them articulate their end investment goals and ensure the correct ownership and finance structures to avoid unnecessary additional expenses in stamp duty or capital gains in the future.

Broadly speaking, when you engage with our property division, you’ll also enjoy access to McKinley’s network of proven and trusted specialists in the fields of finance broking, real estate, property coaches, architects, builders and developers.

Continue Reading

Read more info and property tips on our blog. We also have online financial calculators for your property needs, including a comparison rate calculator, home loan offset calculator, property selling cost calculator and many more.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

cfo2go

- key services

- management accounting & reporting

- budgeting & cashflow modelling

- bookkeeping

- cloud software advisory & implementation

- strategic planning

- business overview

- process development & improvement

How does ‘full time focus, part time cost’ sound to your business?

Cfo2go is a McKinley Plowman initiative aimed at businesses that either can’t afford or can’t justify the cost and time of employing a full time Chief Financial Officer. Highly qualified and experienced in accounting, taxation, wealth, finance, business development and mentoring, the cfo2go team provides businesses with a full-time professional focus for a part-time cost. A major advantage of cfo2go for increasingly cost-conscious business owners is the ability to access a broad range of professional financial expertise with the one budget – backed by the diverse service offering of one of WA’s most successful independent accounting firms.

Don’t just take our word for it – the hard work and dedication of our wonderful Cfo2go team saw McKinley Plowman take out the national 2023 Client Choice Award for the Best Bookkeeping & Payroll Firm.

If your business is new, undergoing change, growth or restructuring, then McKinley Plowman’s cfo2go can make a positive difference. We drive owners to thrive in any environment by increasing efficiencies, creating savings, and fostering growth and innovation.

Continue Reading

Read more on our blog about how our cfo2go initiative can help your business

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

brand plus

- key services

- marketing strategy development

- social media strategy & creative

- branding & logo development

- web build project management

- collateral & stationery design

- content marketing

- digital advertising

- reporting & reviewing

- brand & marketing health checks

As accountants and advisers, we help our client’s businesses and products get their ‘game on’ every day with respect to how they run. But what about how they look and feel? Rather than outsource marketing and advertising, and exposing our clients to the dark and dangerous world of creatives, we developed an internal Advertising Agency called ‘Brand Plus’.

Working within the agreed constraints of your established budgets, we can facilitate everything to do with marketing and advertising – from brand and marketing health checks through to strategic marketing sessions, logo and brand development, websites, and press, radio and TV advertising. We have a dedicated Account Director to guide you through every step of the way.

Below are a couple of our clients that we recently assisted with branding and advertising. One was a start-up and the other a full rename and re-positioning of an existing business. If you’d like to know more about Brand Plus, we’d love to hear from you today!

Read our tips for developing and maintaining a healthy brand on our blog

Preferred group

New name, new logo, photography, corporate assets and website.

Lead and inspire

Logo, slogan, corporate assets and website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

SMSF

- key services

- annual compliance and reporting

- pension and benefit design

- SMSF estate planning

- compliance advice

Self-Managed Superannuation Funds (SMSFs) can be an ideal choice for business owners and individuals looking to control their own superannuation.

McKinley Plowman has a range of tailored SMSF products, and our team of dedicated professionals can assist in the establishment of a fund that will allow you to make strategic decisions and decide where and how to invest your money. With a McKinley Plowman SMSF you get flexibility and choice, along with the secure feeling that you have the backing of our professional team, from establishment, preparation and lodgement of financial statements and tax obligations through to effective financing, tax planning and wealth building strategies.

McKinley Plowman SMSF: Award-Winning Service

Our dedication to providing industry-leading SMSF services has seen us take home the award for the Best Self-Managed Super Fund Firm (<$30m revenue) in the nation-wide 2023 Client Choice Awards. So, if you engage McKinley Plowman to assist you with your SMSF needs, you can be sure that you’re dealing with the best in the country.

SMSF Setup

As with many financial products, establishing a Self-Managed Superannuation Fund (SMSF) is best left to the professionals. At McKinley Plowman, we firstly assist by determining whether your goals and financial position make the setup of a SMSF feasible for you. This includes evaluating your super balance (typically at least $300,000 is required to make a SMSF viable) and understanding how it will fit into your overall financial plan.

If a SMSF is appropriate, we can establish it on your behalf and guide you through the setup process by coordinating the relevant documentation and structures. Once the fund is active, we can then look after the accounting and audit requirements in order to keep everything compliant.

Strategic Advice

SMSF strategy has become increasingly important as laws relating to SMSFs have become very complex. The need for advice is now more important than ever.

Whether it is doing property development, contributing to your SMSF to save tax on the sale of your business, setting up a pension or dealing with the death of a member, McKinley Plowman can assist with each stage of your SMSF life.

SMSF Compliance

With an unparalleled knowledge of superannuation legislation, McKinley’s SMSF team is well equipped to assist trustees, accountants and financial planners with SMSF compliance.

Continue Reading

General advice warning: The advice provided is general advice only as, in preparing it we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this advice, you should consider how appropriate the advice is to your particular investment needs, and objectives. You should also consider the relevant Product Disclosure Statement before making any decision relating to a financial product.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

due diligence

Why Use Incisive?

- Focused on what’s important to you

- Commercial approach

- Depth of experience across several industries

- Thorough risk identification

- Informative and enlightening process

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

Aged Care Financial Advice

- key services

- aged care advice

- cash flow solutions

- estate planning support

- maximising benefits

- tax planning and optimisation

Gain Clarity, Confidence, and Peace of Mind

Are you overwhelmed by the prospect of navigating the Aged Care system, for yourself or a loved one? Unsure about the costs and how they will impact your Centrelink payments? Wondering how to ensure your legacy is protected while securing the best care? McKinley Plowman’s Aged Care Financial Advice service is here to address those concerns and more, and ultimately provide peace of mind.

Our Aged Care specialists understand the vast and complex considerations that come with this stage of life. We will help you navigate with clarity and confidence the financial impacts of Aged Care services and their associated fees on things like Centrelink payments, your desired lifestyle, and legacy aspirations. We take the time to understand each unique situation and financial position, identify options, outline the costs of appropriate Aged Care services, and guide you through the entire process.

Personalised Assistance for Your Unique Situation

Our specialists are dedicated to helping you and your loved ones navigate the various processes and potential pitfalls of accessing Aged Care. It’s never too early to start planning for your later years.

If you’re seeking aged care advice on behalf of a loved one, we can assist with that too. As they start to consider their aged care options, the transition can seem overwhelming. During this difficult time, filling out forms or obtaining documents may be the last thing anyone wants to do. Your financial adviser can help ensure your loved one’s needs, both financial and emotional, are fully considered.

Comprehensive Financial Guidance

Our Aged Care Advice service starts with an initial discussion, where we seek to understand your unique circumstances (or those of your loved one who requires advice). Following that initial discussion, we can assist with various strategies and considerations, including but not limited to:

- Upfront Costs: Determining applicable accommodation payments and how to fund that cost, whether through a lump sum, periodic payments, or a combination of both.

- Keeping or Selling the Home: Advising on whether to keep or sell an existing home, and the subsequent implications for Age Pension entitlements and means tests, and ongoing care costs.

- Maximising Benefits: Recommending investments to maximise Age Pension entitlements and ensuring sufficient cash flow to meet ongoing care costs.

- Estate Planning: Identifying assets for the estate and ensuring relevant beneficiary nominations are made.

- Tax Considerations: Reviewing tax offsets, including low income and seniors and pensioners tax offsets, and addressing issues like land tax and capital gains tax where applicable.

In addition to the above, our advisers work closely with estate planning professionals to ensure that your estate is distributed according to your wishes when you pass on. Effective estate planning considers who assets are distributed to, as well as seeking to do so in as tax-effective a manner as possible. Much like aged care advice, making these arrangements well ahead of time is advisable.

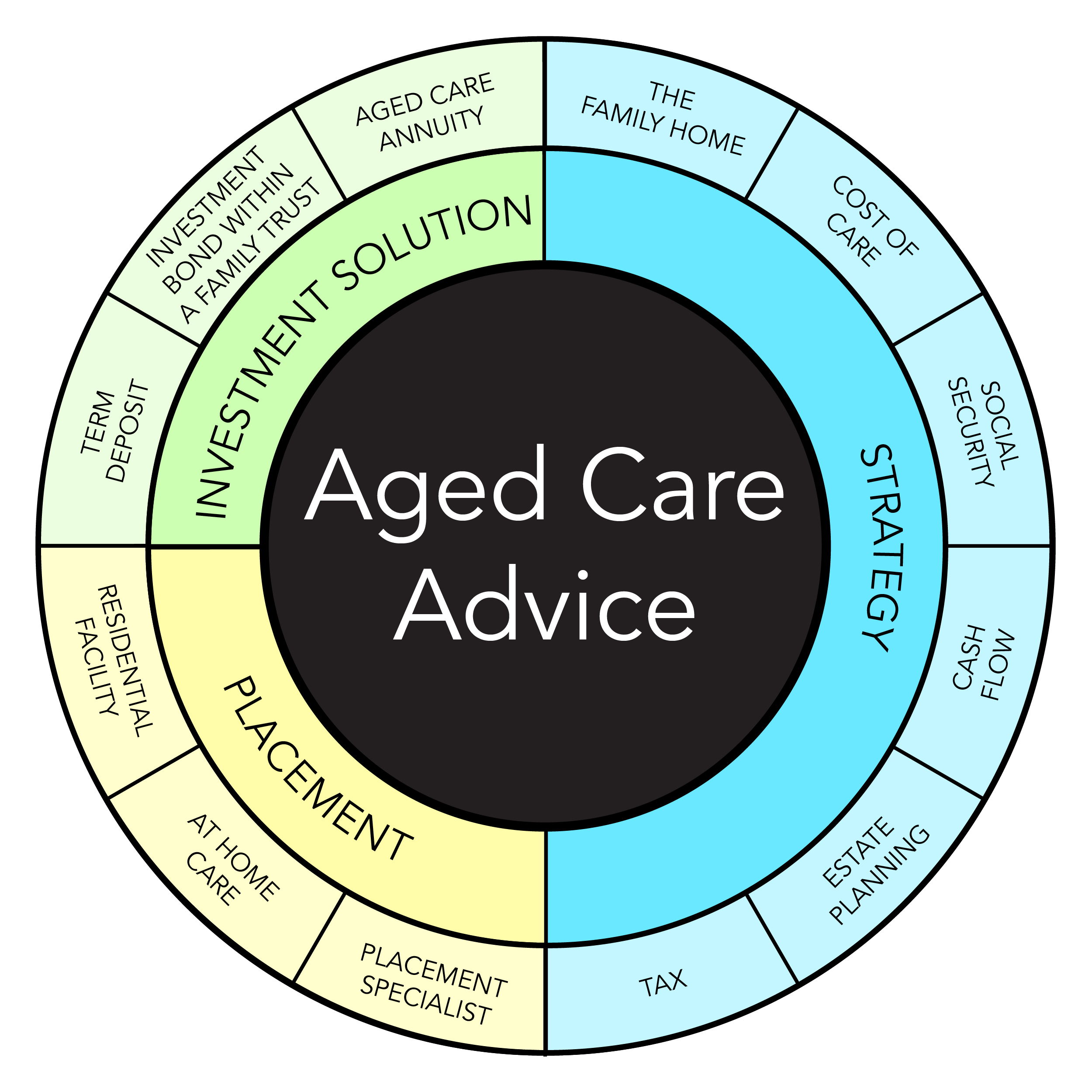

Aged Care Financial Advice – Simplifying Complexity

There are a number of considerations that must be made when planning for Aged Care. Below is an overview of the various aspect we take into account when conducting Aged Care advice – as you can see there is a lot that goes into it and it’s easy to see why people that go it alone can find themselves overwhelmed.

Aged Care Advice – What Our Clients Are Saying…

At McKinley Plowman, the value of our service is in simplifying and streamlining the transition to Aged Care. We leverage the experience of our in-house specialists and network of professionals to ensure every client is looked after, and all applicable avenues are explored. But don’t just take our word for it – hear from a few of our Aged Care advice clients below:

Client Testimonial – Clive Nealon

After my wife developed Alzheimer’s disease, the subsequent dementia meant that she needed full time care in an aged care facility. After several less-than-positive personal enquiries to aged care facilities, I engaged McKinley Plowman to assist. The MP+ team helped clarify the financial situation that we faced and proposed a solution that has worked well for us both. They explained our options and ensured we had a plan in place to take care of the transition to Aged Care.

Following that, MercyCare Joondalup were very helpful in explaining how their side of the process worked, and took us on a tour of the facility. From there, I was able to work alongside MP+ and MercyCare to put our plan into practice. My wife was reluctant to move to the home but it was necessary for her own wellbeing. For me, a load was lifted and although it was a very emotional time for both of us, everything proceeded smoothly. I feel that MP+ took a lot of the ‘heavy lifting’ out of our situation, and freed me up to concentrate on my wife’s welfare. The outcome was an affordable and straightforward solution – while difficult at first, everything eventually settled down and life has normalised for both of us.

I would most definitely recommend McKinley Plowman’s Aged Care Advice services to others.

Client Testimonial – Andy Clayton

I have been a tax and financial planning client of McKinley Plowman’s for around 15 years, so when I needed assistance to manage my father’s finances in early 2024, I turned to MP+. As he had recently moved into an Aged Care facility, we sought advice on the best way to manage his assets and ensure regular cashflow. Nick and his team at MP+ delivered timely and sound advice on optimising dad’s financial situation, and we now have the peace of mind knowing his assets are protected, his tax liabilities have been reduced, and he receives a monthly annuity payment.

Nick and the team have been professional all the way through, had the knowledge to answer all of my queries, and ultimately we are very satisfied with the outcome. I would recommend MP+ Aged Care Advice services to anyone in a similar situation.

Client Testimonial – Helen Wilson

In November 2022, we engaged McKinley Plowman to provide advice as my father was entering an aged care facility. Along with aged care, we also required advice on Centrelink Age Pension benefits, and setting up a financial plan for the future. Having no prior experience with financial advice or the aged care system, we were relieved that Nick and Shona at MP+ took a lot of the stress out the situation and made the process easy for us with their sympathetic and professional approach. Mum and Dad are now completely set up and satisfied with the advice they received and are able to afford their living expenses and look to the future without worry. I would completely recommend McKinley Plowman’s Aged Care Advice services to others.

Your Aged Care Advice Journey

If you or a loved one are considering your aged care options, seeking financial advice early is important. To arrange a complimentary consultation with one of our Aged Care advice specialists, please contact us on 08 9325 2411 (Perth), 08 9301 2200 (Joondalup), or via our website.

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

Estate and Succession Planning

- key services

- estate planning

- business succession

- deceased estates

- executor support

In both our personal and professional lives, we aim to look after ourselves in the moment. But are we doing all we can to prepare for the future? At McKinley Plowman, we help our clients take stock of what they have now and develop strategies to protect their assets down the track. From looking after your family’s finances to ensuring your business can run smoothly in your absence, estate and succession planning is the key to a secure future for your loved ones. We take the time to get to know your priorities on both a personal and business level, and determine the best structures to implement your wishes. After all, you’ve worked hard to generate your wealth, so it’s sensible to ensure it is future-proof.

The extent of business succession planning benefits includes increased and measurable improvement in business profitability, improved cash flow, sustainable growth and increased business value. This is something all businesses deserve and have the capacity to make a realistic goal.

Estate Planning with McKinley’s takes care of a multitude of issues such as creating a robust Will, determining Power of Attorney, taxation matters and asset transfers and documentation. In the case of any contentious issues ‘after the fact’, we will have already appointed on your behalf a carefully selected legal adviser who will ensure that Estates wishes are strictly adhered to.

Looking after you now and in the future – partners for life.

Continue Reading

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

Insurance and Risk Management

- key services

- general insurance

- management liability

- personal insurance

- tpd & life insurance

- risk mitigation

Create wealth, build on it and protect it. Whether you’re starting a family, in business, gearing up for retirement, or somewhere in between – it’s crucial to look after yourself and your family by protecting your wealth. At McKinley Plowman, we understand the value of strong insurance policies that secure the important things in your life, and we seek to assist clients in developing sound risk mitigation strategies that address potential issues in a proactive manner.

When you’ve put your heart and soul into building and maintaining a successful business, the last thing you need is to be derailed by something that could have been covered by a robust insurance strategy. This is why it is so important to be proactive and forward-thinking in your approach to general insurance, and combine your intimate knowledge of your own business with our expertise in the world of insurance and risk management. We’ll help you understand what policies and products will work best for you, why they work, and then implement on your behalf. Managing the claims process also no longer needs to be a hassle, as our insurance team take the reins and champion your cause with insurers.

At MP+, we help clients to review their risk exposure and implement a personalised solution that will ensure you and your loved ones have peace of mind in the event of the unexpected. We’ll look at insurance products such as Life, Total & Permanent Disablement, Trauma and Income Protection cover and formulate an implementation plan to get you and your family insured.

We will help to identify the minimum level of cover necessary to meet your needs as well as conduct a health check on your existing arrangements so we can let you know what you are covered for and what you’re not; and ensure you get the best value for money.

If you’re looking for more information on personal/life insurance services or to find out how we can help you review and update your personal policies, please visit our wealth section.

Continue Reading

Thinking about becoming a client?

Book your free, no obligation consultation right now via our online booking system or get in touch to find out more

Already a client and want to get in touch?

Send us an email via our enquiry form or give us a call today

testimonials

Our dedication to customer service is at the top of our list – read some of the fantastic feedback our clients have passed onto us.